Theoretically, the value of stablecoins is always stable. But in reality, it does not rule out certain conditions that can result in price deviation. Currently, there are 5 top stablecoins listed on the CMC including USDT, USDC, DAI, PAX, and TUSD, and they all have experienced price deviation ranging from 0.72 USD to 1.37 USD. Even so, they all can always manage to return and maintain its value at the pegged price where 1 stablecoin is 1 USD. Price deviation is inevitable and can indeed be a big threat, but the most important thing is how the system can stabilize the value of their stablecoins at the pegged price.

USDQ is a new USD-pegged stablecoin. Just like other stablecoins, USDQ also experienced a price deviation. The difference is the unique ecosystem of Q DAO as a producer of USDQ. On Q DAO platform, users can generate USDQ by collateralizing and locking Bitcoin (BTC) in a Collateralized Debt Position (CDP) smart contract. CDP smart contract will always ensure that the value of 1 USDQ is 1 USD either when the user receives or pays a loan, regardless of the USDQ price on the secondary market.

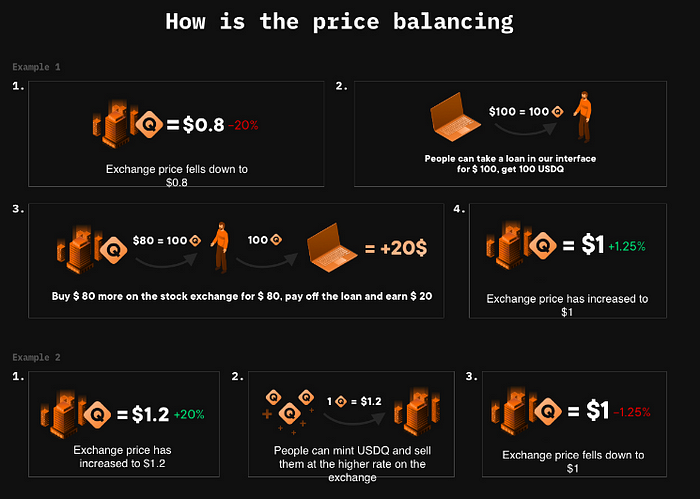

In the Q DAO ecosystem, price deviations will benefit the user. When USDQ is traded higher in the secondary market, users can buy USDQ on the DAO Q platform at a rate of 1 USDQ = 1 USD and immediately sell on the secondary market to make a profit. Conversely, when USDQ is traded lower on the secondary market, users can buy USDQ from the secondary market and sell to smart contracts on the Q DAO platform for profit. Both conditions will benefit the user and at the same time, will stabilize prices on the secondary market to 1 USD. Please note that only users who have collateralized their assets on the Q DAO platform can be involved in this activity.

Q DAO platform is protected from hacking or security breaches but that does not mean Q DAO platform cannot be attacked. The possibility is always there, as well as the price of USDQ which can be very chaotic at any time. To overcome these unwanted things happening, Q DAO platform has prepared various steps and the last step is emergency shutdown. The emergency shutdown is triggered when Q DAO voter identifies signs of a major attack on the ecosystem. After activation, all operations are stopped to prevent further disturbance and manipulation. Q DAO governance will determine the period for completing all ongoing collateral auctions. After the end of the period, USDQ holders can claim the value of their assets by interacting directly with smart contract. Q DAO platform will stop the price feed at the effective price for use in withdrawing the net value of the user’s collateral assets stored in the CDP smart contract.

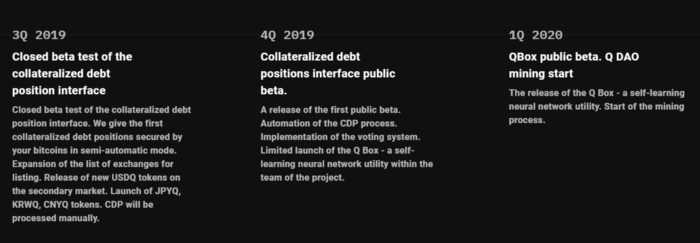

USDQ Roadmap

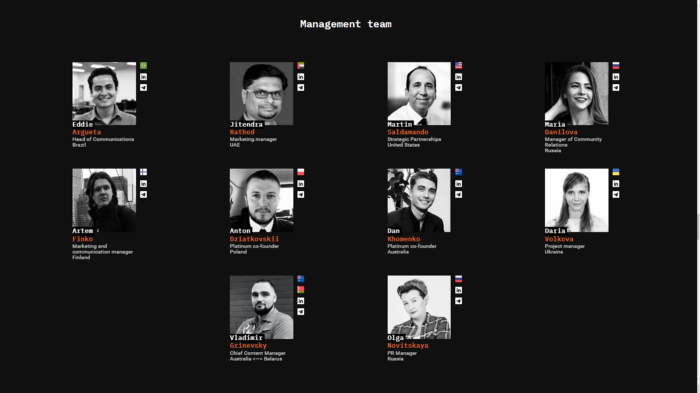

USDQ Team

For further information, please visit:

Website: https://usdq.platinum.fund/

Twitter: https://twitter.com/platinumqdao

Telegram: https://t.me/Platinumq

BTT Author Link: https://bitcointalk.org/index.php?action=profile;u=2604214

No comments:

Post a Comment